For anyone born before the year 2000, music meant MTV, LPs, CDs and Walkmans. But in the past decade plus, enjoying your favorite hits has been all about music streaming apps, the most popular and well known being – of course – Spotify.

A Swedish born company, the music app was first envisioned by co-founder Daniel Ek in 2002, around the time that the file sharing website Napster became defunct. It was clear that the public wanted an easy way to access music online and together with co-founder Martin Lorentzon, the company finally launched in 2008.

The streaming app, whose name is a combo of “Spot” and “Identify”, provides users with millions of music titles and podcasts in every imaginable genre. The brand concept is to give users an easy way to find and enjoy the music and audio content they love, on demand. And it works.

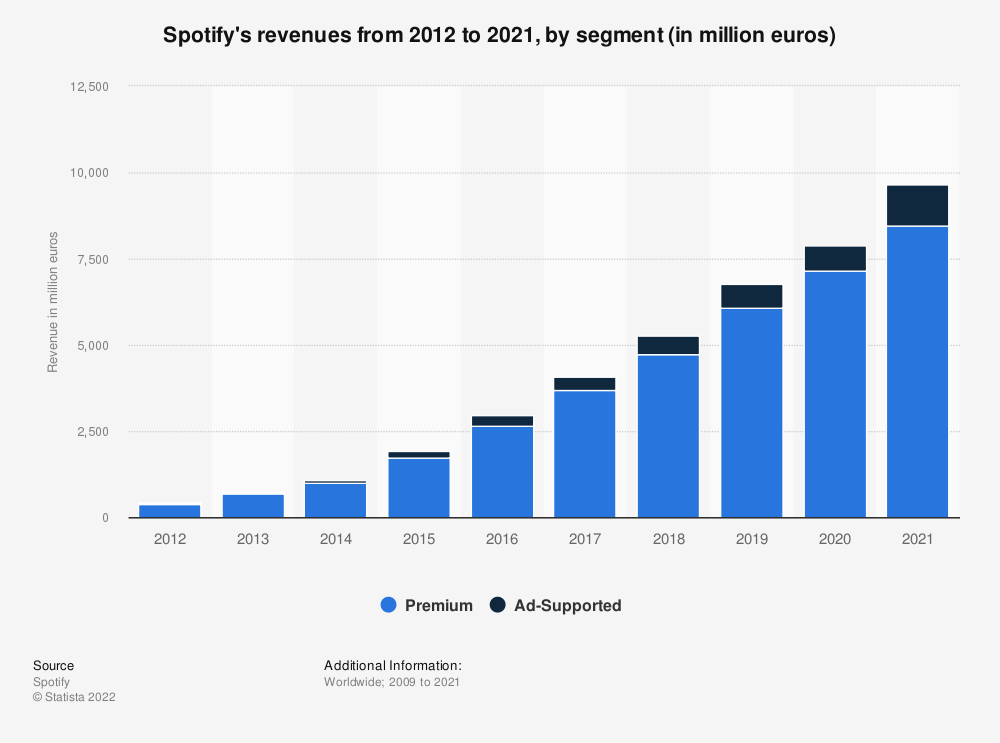

The number of how many people use Spotify worldwide has been steadily rising year-on-year, reaching 422 million monthly active users in 2022. Of these, 182 million are paid subscribers. The company’s reported revenue in 2021 was the highest ever to date: 8.5 billion euros in premium subscription revenue, and 1.2 billion euros in ad supported revenue.

So who is the target market for Spotify that is driving these numbers, and how is Spotify business strategy able to achieve such success, particularly against formidable competitors, like Apple Music and YouTube? Let’s take a look.

Who is Spotify’s target audience?

The Spotify target audience is located worldwide, with more users in Europe than any other region. The typical Spotify user is young adults – Millennials and Gen Z – however there is not a small audience of older adults aged 55+ who also enjoy the app’s music.

The Spotify audience skews more female than male – 56% female to 44% male – and the average user is loyal, spending around 118 minutes a day listening to Spotify.

A focused analysis of Spotify user statistics will give an even deeper understanding of these and other data points.

Spotify Target Market Segmentation

If you are marketing to users similar to the Spotify audience, take into account Spotify demographics, geographic, behavioral and psychographic segmentation data. This will give you better understanding and insights to target your audience more accurately. Let’s explore these Spotify customer segments one by one.

Spotify Demographic Segmentation

Although the brand is popular among all age groups, it is stronger with young audiences. 29% of Spotify users are members of the millennial generation, and 26% are under 24 years of age.

In fact, in 2020, Spotify was the most popular online music service in the US for those aged 12 to 34. In contrast, the over 55s Spotify age group of users makes up 19%.

Spotify’s freemium subscription is highly popular among younger users – 71% of people using Spotify for free are under 35 years old.

Spotify Geographic Segmentation

The Spotify customer segmentation is largest in Europe, with 66 million users in Europe vs 48 million in the US, 33 million in Latin America and 18 million in the rest of the world.

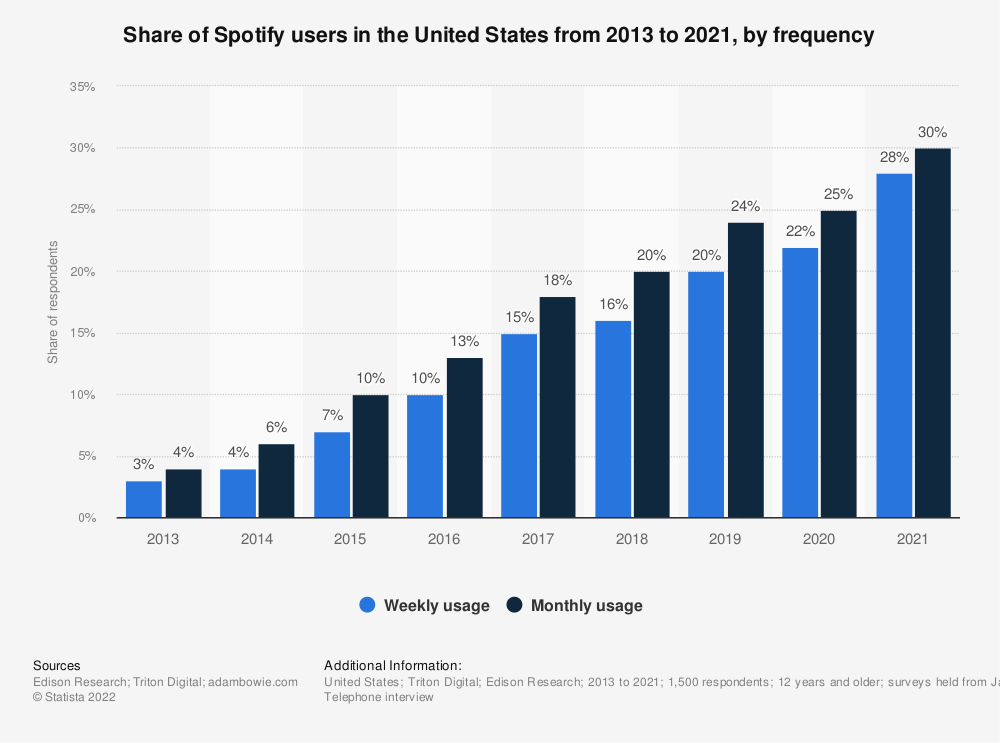

In the US, the target audience are frequent users of the audio streaming service. 30% of US listeners tune in to the music app on a monthly basis and 28% listen to it weekly – a figure that has grown steadily over the past decade.

Spotify Behavioral Segmentation

Spotify users typically enjoy the personalized experience offered by the platform. More than a third of the time spent on Spotify is listening to playlists, of which 36% are created and shared by other users.

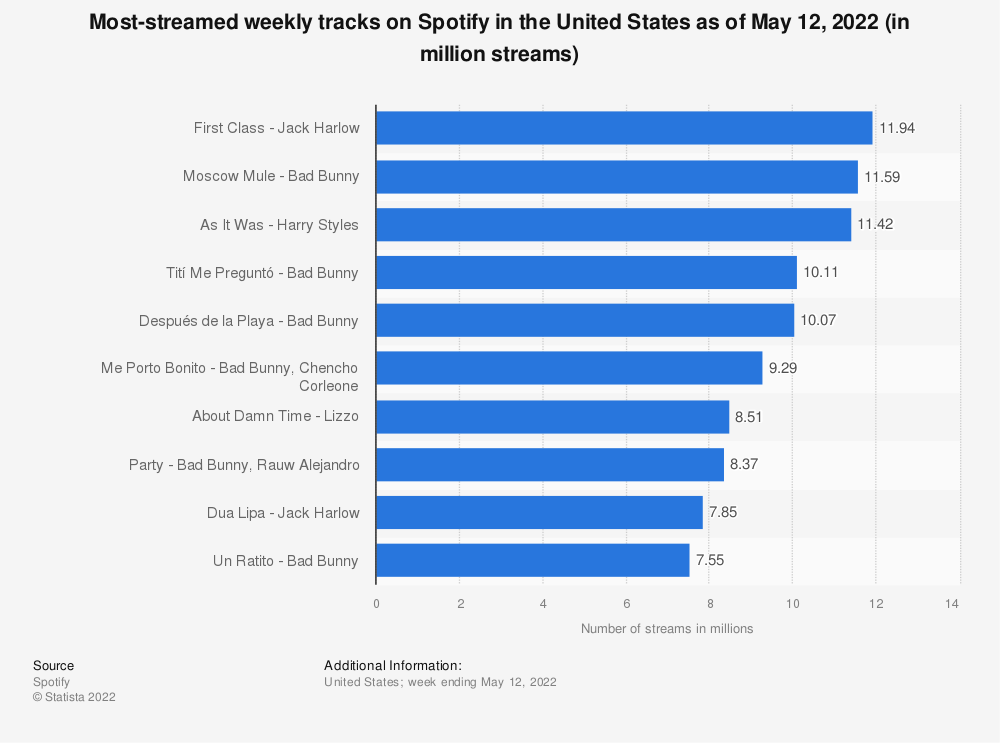

Streaming preferences are highly variable depending on location. In 2022 so far, the most streamed track on a weekly basis among the global audience is Heat Waves by Glass Animals, whereas in the US, it’s First Class by Jack Harlow.

Spotify’s success goes beyond music streaming. In 2022, the brand took the top spot in monthly number of podcast listeners (32.5 million), overtaking even Apple Podcasts, which moved to second place with 28.5 million listeners.

Spotify Psychographic Segmentation

Spotify’s popularity among Millennials correlates with the generation’s attitude to media consumption in general: 60% say that audio is the most immersive form of media. Spotify’s vast audio library of 70 million song titles and nearly 3 million podcasts appeals deeply to younger listeners aged 14-35. This segment tends to veer away from mainstream music and look for more indie and alternative styles.

It has similarly been noted that users aged 42 and over have a tendency to return to mainstream pop music. Spotify uses data-based personalization to recommend music and audio content to individual users according to their changing preferences and in-app behavioral data.

Who are Spotify’s competitors?

Spotify faces tough competition, including global brands such as Apple, Amazon, Pandora and more. Even so, Spotify manages to retain top spot as the number one music streaming app, with 31% of global market share, followed by Apple (15%) and Amazon (13%).

In 2020, Google shut down its Google Play Music service and transitioned all tunes to YouTube Music, where a large and engaged target audience already existed. The move paid off, with YouTube Music steadily gaining market share in the audio subscription space – impressive growth of over 50% in the year leading up to Q2 2021.

Pandora is another key name among Spotify competitors, but its active user base appears to be ‘flatlining’ in comparison to Spotify’s growth. While Spotify is expected to have 98.8 million subscribers by 2023, Pandora’s base number is predicted to decline further despite strong revenue growth, most of which comes from advertising.

Pandora and Spotify both compete strongly for the younger Millennial and Gen Z market. According to mobile data of Pandora Music users in the US, the largest segment by far falls into the 25-34 years age bracket (48.1%), followed by 22.8% from the 18-24-year age group.

Amazon Music is another popular and growing name among Spotify competitors. Unlike Spotify, Amazon Music does not offer a freemium plan and is completely free of advertising.

Amazon Music listeners in the US numbered 30.4 million in 2018, and that figure is predicted to reach over 48 million by 2023. This reflects significant growth, but still far short of Spotify’s expected growth.

Spotify Marketing Strategy

Spotify uses a comprehensive and multi-channel marketing strategy that covers social media, OOH (billboards and posters), viral memes, personalization of the in-app user experience, and more.

One of the biggest advantages of Spotify marketing is its access to vast user data to help them understand what users are listening to and create targeted and effective marketing campaigns. For example, in a 2018 campaign based on Spotify market research, the company called out different goals viewers could have for the year, highlighting weird and wacky user-generated playlists.

The snarky and clever campaign was highly popular, appealing to the zeitgeist of the younger Millennials, a key segment of the Spotify target market.

Spotify brand strategy also includes its clever pricing plans. For example, the streaming app offers a 50% discount for students at accredited higher education institutions, targeting cash-strapped students with a significantly reduced price.

Spotify also appeals to couples with a Duo plan at a discounted rate, and a Family plan of up to 6 Premium accounts for users living at the same address.

In 2022, the brand expanded its lifestyle offering with a new product launch, “Spotify Car Thing”. The device is designed for use in the car, enabling subscribers to enjoy the full app experience while on a road trip, commuting to work, or stuck in traffic.

The Car Thing is part of an overall Spotify audience targeting and retention strategy designed to make Spotify a seamless companion for users, accessible whenever and wherever they are.

https://www.youtube.com/watch?v=uVdED-MA5FI

Spotify Music Users in United States

In the US, a significant number of mobile users – nearly 8.2 million – fall into the consumer segment of Spotify Music Users. Of these, there are significantly more males (58.6%) than females (41.4%), and the top 5 devices used by listeners are all Samsung made.

Start.io demographic data of mobile users who listen to Spotify correlates strongly with the company’s own target market – close to 85% are aged 18 to 34 years. Interestingly, the socio-economic strata of Spotify users according to mobile data skews both high and low. 28.6% have an annual income of less than $25K, while 28% earn much higher, between $100K and $150K.

These kinds of insights and more can all be found at the Start.io Consumer Insights and Audiences Hub, and not just for Spotify Music Users in the US. In fact, the Audiences Hub features 500+ consumer segments across all categories and niches, and hundreds of geographic locations in the United States and all over the world.

With access to this deep pool of up-to-date mobile user data, Start.io provides businesses with the relevant insights they need to create better mobile advertising campaigns and more accurate targeting strategies that drive results.

Spotify FAQs

How many people have Spotify?

According to Spotify statistics 2022, over 420 million people worldwide use Spotify.

How many people have Spotify premium?

There are 182 million paid subscribers to Spotify Premium.

How many songs does the average person have on Spotify?

The Spotify library includes 70 million songs and nearly 3 million podcasts. While it is impossible to pinpoint how many songs people have on Spotify ,it is known that the average active Spotify user spends around 25 hours a month listening to Spotify.

What makes Spotify different from its competitors?

The key distinguishing character of Spotify is its advanced machine learning algorithms that enable highly accurate personalization of songs and curated playlists for individual users.

Sources